Published by Rupert Moyle on 23 October 2020

Last updated 23 October 2020

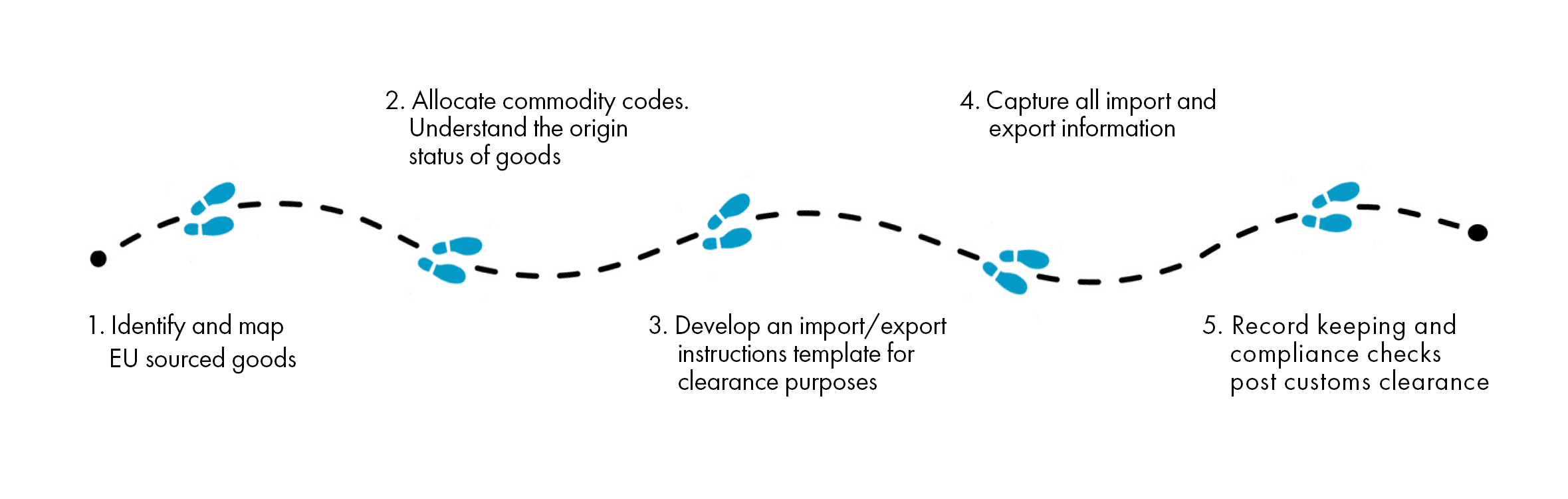

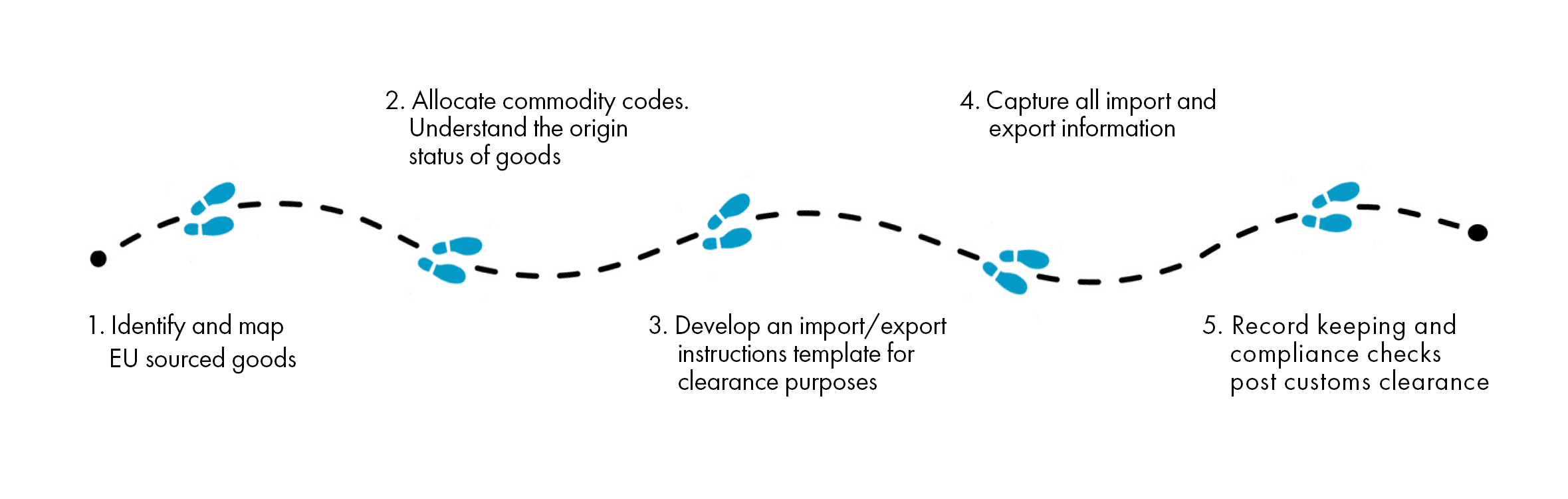

Our team of VAT and Duty specialists provide clear advice and solutions to the potential VAT and Duty implications of Brexit and have identified five key steps that you should take for your business.

Step 1 – Identify and map EU sourced goods

- Understand the goods being sourced and imported/export to/from the UK

- Understand the Incoterms (a series of pre-defined commercial terms published by the International Chamber of Commerce relating to international commercial law) the goods are sold on and the associated responsibilities

- Are the goods remaining in the UK after importation?

- Identify the status of goods (free circulation/suspensive regime)

- For goods exported from the UK, is there a need for an overseas VAT registration and EU EORI?

- Do you need an EU establishment?

Step 2 – Allocate Commodity code and Origin status per product

- Classify the goods to 10 digits for import purposes

- Understand the origin of the goods to identify any opportunities under a UK Free Trade Agreement

- Identify duty rates and duty due at import to the UK to understand landed costs

- Consider any Anti-dumping Duty EU and/or UK, if goods are not EU origin for sourcing purposes

Step 3 – Develop an import/export instruction template for clearance purposes

Prepare an import/export instruction sheet for presenting to the customs clearance agent to ensure the goods are imported/exported correctly. Information provided to include:

- Commodity code

- CIF value

- Origin status of the goods and applicable documentary evidence

- Customs procedure codes – subject to import “type”

- Where copy import/export documentation should be emailed for record keeping

- Ensure compliance with VAT legal requirements on documentation, e.g. description of goods

- Develop policy for retention of export evidence for HMRC VAT and duty audits

Step 4 – Capture all import/export information into a shipment log

Develop a shipment log to capture key import/export information to allow the following:

- Identification of all import shipments per import entry number and date

- Noting “checked” status after compliance checks are completed

- Check any evidence required under any free trade agreement is held

- To check all HMRC supporting documents held for VAT/duty audit purposes

- Ease of presentation for future HMRC audits

Step 5 – Record keeping and compliance checks

- Ensure copies of all import/export entries are obtained from the customs clearance agent after import/export

- Double-check all documentation is held using the shipment log

- Check the import/export entry against the instruction template to ensure the import/export has been completed correctly. Note all compliance checks on Shipment Log.

- Advise any errors to the original customs clearance agent for amendment

- Store all import/export documentation electronically or hard copy filed per month per entry number for ease of location for future HMRC audit