16th April 2024 Non-dom regime – time to act now

Following on from the update in March after the Spring... Read more

Suggested:Result oneResult 2Result 3

Sorry, there are no results for this search.

Sorry, there are no results for this search.

View all peopleFollowing on from the update in March after the Spring... Read more

A small team from Kreston Reeves and Brachers were privileged... Read more

This time last year, we were delighted to achieve B... Read more

It is now expected that the Government will call a... Read more

There are many ways to help reduce your income tax... Read more

The demand for new homes is greater than ever and... Read more

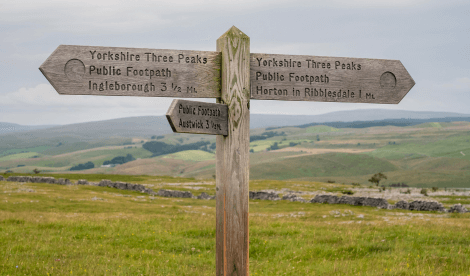

This year, a team of 9 are excited to take... Read more

The Education & Skills Funding Agency (ESFA) has published its... Read more

Reclaiming overpaid tax with overpayment relief As the saying goes... Read more

The start of Spring beckons the directors of property companies... Read more

Download this issue for valuable business and commercial insights for... Read more

The Government has announced that the company corporate reporting thresholds... Read more