We offer a comprehensive approach to providing international tax services to large corporates, entrepreneurial growth companies and internationally mobile high net wealth investors.

Our collaboration with Kreston colleagues across the globe and the holistic partner-led strategy are key strengths that are a benefit to meet the needs of businesses, individuals and their stakeholders. Whether it’s assisting large corporations, supporting growth in entrepreneurial ventures, or managing the complex tax situations of high net worth individuals, we are well-equipped to handle a variety of tax-related needs.

If you’re looking for specific information or assistance related to cross-border taxation it’s about tax regulations, compliance, optimisation strategies, or any other related topic, Kreston Reeves can help.

International tax services for businesses

Examples of how we help our business clients:

- Structure their Intellectual Property (“IP”) tax efficiently across multiple jurisdictions.

- Establish tax efficient financing structures.

- Structure acquisitions and joint ventures tax efficiently across multiple jurisdictions.

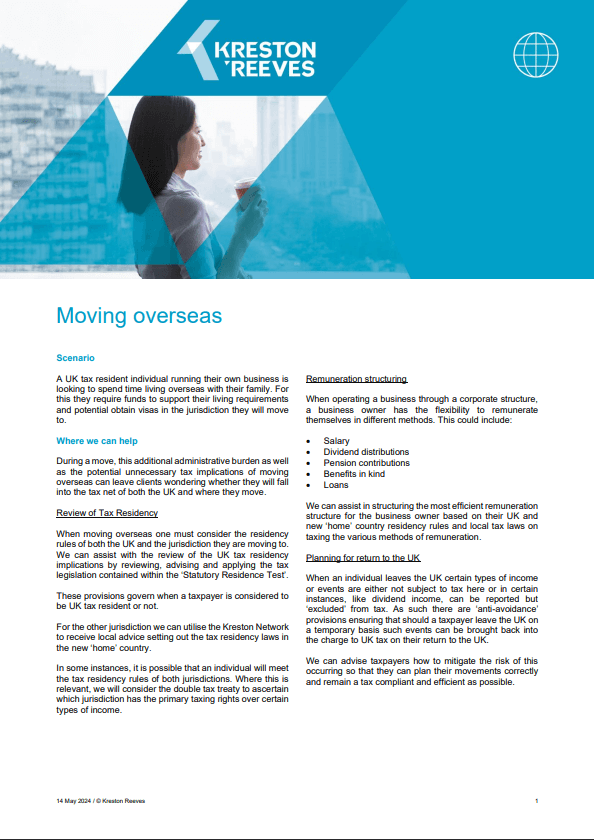

- Manage their residence and domicile status and manage their exposure to UK tax.

- Structure their investments tax efficiently into new jurisdictions.

- Manage VAT and Duty providing advice and solutions on indirect tax issues.

- Provide expert support in cross-border transactions, ensuring compliance and optimal tax outcomes

International tax services for individuals

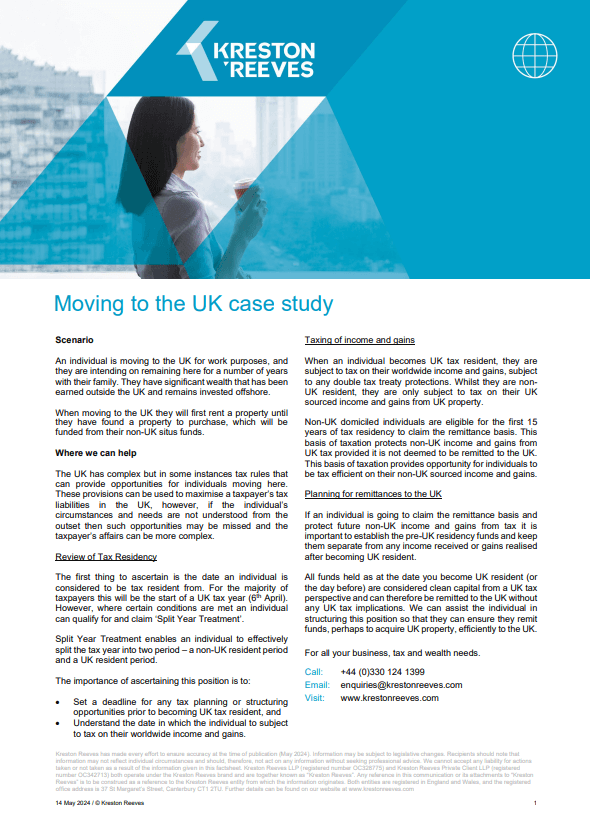

Examples of how we help our private clients with international tax:

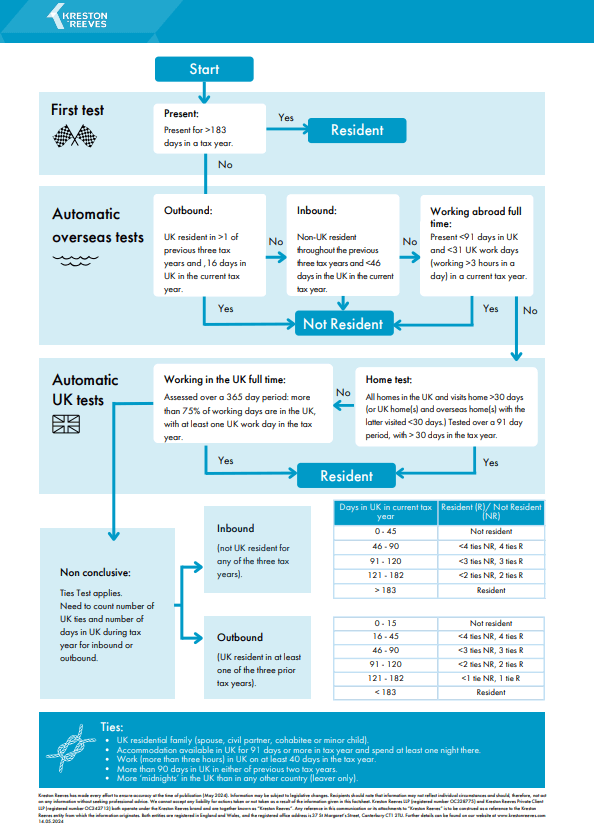

- Review of Tax Residency status.

- Review of domicile for tax purposes, including the use of offshore trusts for estate and succession planning

- Supporting inbound individuals and their family regarding their tax status in the UK and requirements they are.

- Review of relevant legislation to optimise tax efficiency.

- Assist inbound and outbound employees regarding their UK income Tax and National Insurance obligations.

Transfer Pricing

We provide benchmarking and documentations services, including dispute resolution, ensuring you are compliant with transfer pricing and cross border obligations. As a member of the Kreston network, we work with leading experts around the world to help your business meet both OECD and location requirements.

Recent work for our international clients includes:

What does an international tax adviser do?

What does an international tax adviser do?