Helping businesses every step of the way

The challenge of balancing managing, evolving and running an organisation, complemented by a drive to achieve strategic objectives are often being diverted to deal with the financial aspects of running an organisation.

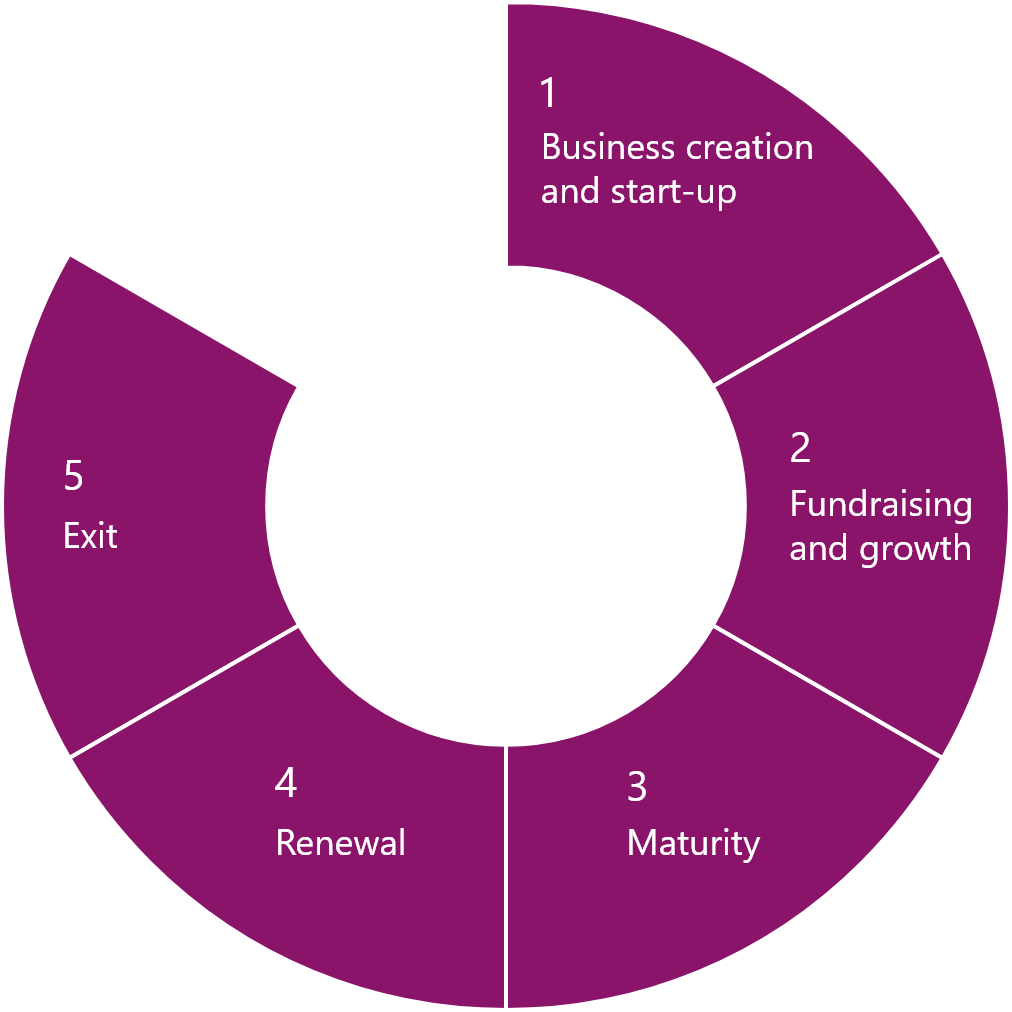

A successful business needs the continuous support and advice from professionals to help alleviate diversions, improve performance and profitability. The business life-cycle stage you focus on today will require change and a new focus in the future, to be successful.

A life-cycle is rarely linear in that you can go forward as well as back; and because of this there is a need to understand each cycle and its challenges.

In this brief description, you’ll learn what upcoming challenges, focuses and financing sources you will need to consider at every stage of your business’ life.

Business creation and start-upFunding and growthMaturityRenewalExit

Business creation and start-upFunding and growthMaturityRenewalExit Tap a segment to

jump to that stage

Business creation and start-up

Many believe this is the riskiest stage of the entire life-cycle and that mistakes made at this stage affect a company years down the line; early mistakes being the primary reason 25% of start-ups do not reach their fifth birthday.

Over 99% of businesses in the UK are small or medium sized enterprises. Most started with some sort of business plan.

A business plan is not just a tool for an entrepreneur seeking funds, but a platform to distil market analysis, strategy, cash flow analysis, product development and objectives.

Smart leaders now set the direction and articulate the core values in the business plan, before the goals. Implementation used to be the important bit that came at the end. It is now at the heart of the process and is the strategy. The trick is to find a process that works for you and a business adviser can help you with this!

A lot of the early risk can be reduced by structuring your start-up correctly and using a robust online accounting software that can handle growing with you.

Once the legal framework of your start-up has been installed, adaptability is essential. Much of your time will be revisiting your business plan to meet your audience’s needs – with financial aspects such as VAT (once the threshold has been breached), payroll and funding increasingly taking precedence.

Funding and growth

With growth aspirations, maybe international expansion, comes the need for additional funding or a refinance. The normal path for a company looking for funding is not set in stone. The path changes with trends, micro and macro factors and influences like geography, for example regional growth funds.

Understanding the best source of funding for your business is fundamental to help exploit the company’s growth potential.

With a consistent source of income come cash flow stability, and the potential for growth and establishment.

Sometimes the biggest challenge in growth is dividing your time between the demands requiring your attention. To make growth sustainable, online accounting and outsourced services such as management accounting and finance function, payroll, year end accounting etc. can allow you to focus on your core business: they give you time to focus on building a capable team around you.

Growth also leads to more complex (personal) tax planning – reducing tax liability and maximising the potential to contribute to future plans – and as mentioned before, potentially developing a presence in overseas markets.

Developing a presence in overseas markets comes with a myriad of challenges. While the ethics of doing business do not vary from country to country the legislation which governs business does. A comprehensive understanding of the local law (including employment law), VAT and Duty, cross-border transactions, legislation and tax issues (including: transfer pricing, tax efficient structuring, international tax planning) can be the catalyst to overseas success.

Maturity

It could be said that businesses are faced with two choices when they hit maturity: push for further growth (through merger, acquisition or capital raising), or exit the business through sale or succession planning (assisted by business and share valuations).

Which ever option you choose, the business itself is likely to need an audit, to help highlight potential irregularities and errors, and to potentially meet legal requirements.

Renewal

Evolution or reinvention can be the key to success. A prime example of this is Nokia, founded as a pulp mill, since the 1990s the company has focused on large-scale telecommunications infrastructures. But companies should be wary of trying to replicate such a feat.

A pivot/re investment is a risky move and impossible to predict its outcome: the best require extensive planning and progressive shifts and extensions of your services/products etc.

Or for some, there may be the need to access restructuring strategies for a company in distress, to renew their approach. However this approach is limited by the life-cycle stage they are in and doesn’t naturally fit within one life-cycle. For example, a company in ‘Maturity’ may look to replace top level management, while a company in ‘Funding and growth’ may focus on reducing dividend payments and raise funds from external resources.

Whatever the approach, a business turnaround strategy needs to address the real causes of the problem, not just the symptoms and a restructuring professional can help you with this.

Exit

The moment where you cash out on the years of hard work requires a realistic valuation and an understanding of the financial aspects, both personal and corporate, of stepping away from a business.

If it’s a management buyout (MBO), an initial public offering (IPO) or a business sale there is a need to enlist the help of an accountant to prepare financial paperwork, and a lawyer to help you review offers, contracts and deals.

To ensure that you have sufficient money to enjoy life and do all of the things which are important to you now, minimise tax and protect wealth for the future following the exit of your business, wealth management advice is also key.

Contact one of our specialists today

If you have a question or would like to learn about how we can help you and your business please click here to arrange a no-obligation meeting.

Contact one of our specialists today

If you have a question or would like to learn more about how we can help you and your business, complete the form below to arrange a no-obligation meeting.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.