Alex Knight BA FCA

- Accounts Senior Manager

- +44 (0)330 124 1399

- Email Alex

Suggested:Result oneResult 2Result 3

Sorry, there are no results for this search.

Sorry, there are no results for this search.

View all peoplePublished by Alex Knight on 22 July 2025

Share this article

Making Tax Digital for Income Tax Self Assessment (MTD ITSA) will apply to residential buy to lets, HMO’s and student lets, furnished holiday lets, non-UK property (e.g. a rented holiday apartment), and commercial property.

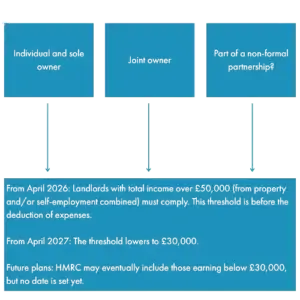

As an individual or joint owner, you will have obligations to keep records and make quarterly submissions on your share of income and expenses under MTD ITSA.

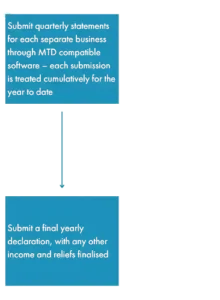

These quarterly updates will be sent from your MTD compatible software, and after the final quarter you will be required to submit a final yearly declaration, where figures, reliefs and allowances, and any other income can be finalised and confirmed.

You will need to combine property income as UK and overseas during the submission, as reporting will not be separated for each property.

If you receive letting income net, after the deduction of fees and expenses, you will need to ensure that you record the gross income received, and then report the fees and expenses that have been deducted separately.

For a jointly owned property, the level of gross income is based on the share of income for each individual.

Digital records can be held by category, rather than transactions, and you can choose to report expenses annually in the final declaration, rather than in each quarterly update.

Starting in April 2025, HMRC will send letters to individuals whose qualifying income sources were close to or over £50,000 based on their 2023/24 self-assessment tax return data. Don’t worry if you receive a letter, there is plenty of help and support available.

Join us for our Landlord’s Guide to Making Tax Digital webinar on Wednesday, 3 September at 10am. You will receive clear, practical advice and an opportunity to ask our experts your questions. Reserve your place here.

Share this article

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Related people

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Our complimentary newsletters and event invitations are designed to provide you with regular updates, insight and guidance.

You can unsubscribe from our email communications at any time by emailing [email protected] or by clicking the 'unsubscribe' link found on all our email newsletters and event invitations.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.