Dan Firmager ACA

- ESG Advisor

- +44 (0)330 124 1399

- Email Dan

Suggested:Result oneResult 2Result 3

Sorry, there are no results for this search.

Sorry, there are no results for this search.

View all peoplePublished by Dan Firmager on 1 September 2025

Share this article

The UK Government is introducing new standards for sustainability reporting, the UK Sustainability Reporting Standards (UK SRS), and they’re designed to help companies report clearly and consistently on environmental and social issues, starting with climate.

For finance and sustainability teams, this could mean getting ready to include new types of information for annual reports in financial statements. UK SRS S1 and S2 are the first two standards, and they set out what needs to be disclosed, how it should be presented, and when it will become mandatory. There is a longer-term view that wider sustainability matters will be introduced in time.

The UK SRS is still in draft form, but the timeline is moving quickly. Here’s what we know so far:

S1 is the general framework that applies to all sustainability disclosures. It’s not just about climate, it sets the rules for how companies should report on any sustainability issue that could affect their business.

A key principle in S1 is materiality. Companies are expected to report on sustainability-related risks and opportunities that could reasonably be expected to influence decisions made by investors, lenders, or other stakeholders. In other words, if something could affect the company’s future cash flows, access to finance, or cost of capital, and it’s likely to be material, it should be disclosed.

These disclosures should be clear, relevant, and connected to the financial statements. S1 also requires companies to use the same reporting boundaries as their financial reports and to avoid repeating the same information across different sections.

In short, S1 is about making sustainability reporting as reliable and useful as financial reporting.

S2 focuses specifically on climate-related disclosures and is broadly built around four key areas – Governance, Strategy, Risk Management and Metrics and Targets.

Companies need to explain who is responsible for managing climate-related risks and opportunities. This includes boards, committees, and senior leaders. The standard also asks for details on how climate responsibilities are built into decision-making and how they link to executive pay.

This section looks at how climate issues affect the company’s strategy and financial planning. Companies should describe:

Companies must explain how they identify and manage climate-related risks. This includes the tools and processes they use, and how these are integrated into their overall risk management systems.

This is where companies report the numbers. They need to disclose:

One of the key features of UK SRS is that these disclosures aren’t separate, they’re part of the financial statements and they need to connect to financial data. For example, climate risks might affect asset values, provisions, or investment decisions.

The assumptions used in climate planning should match those used in financial forecasts. This means finance and sustainability teams need to work closely together to ensure everything lines up.

To help companies get started, UK SRS S2 includes some optional reliefs for the first year:

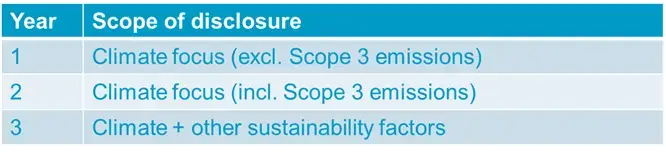

As part of a phased approach to introducing these standards there will be increasing amounts of information requested over a 3-year period, to allow for companies to evolve their understanding and data capture. This has been summarised in the table below:

With final standards expected later this year, it’s a good time to start preparing. Here are some practical steps:

UK SRS S1 and S2 mark a shift in how sustainability is reported. They bring it into the core of financial reporting, and that means Finance Directors and sustainability leads will need to work together more than ever. If you need support in understanding how this applies to your business and what you need to do to prepare, then please do contact us.

Share this article

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Our complimentary newsletters and event invitations are designed to provide you with regular updates, insight and guidance.

You can unsubscribe from our email communications at any time by emailing [email protected] or by clicking the 'unsubscribe' link found on all our email newsletters and event invitations.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.