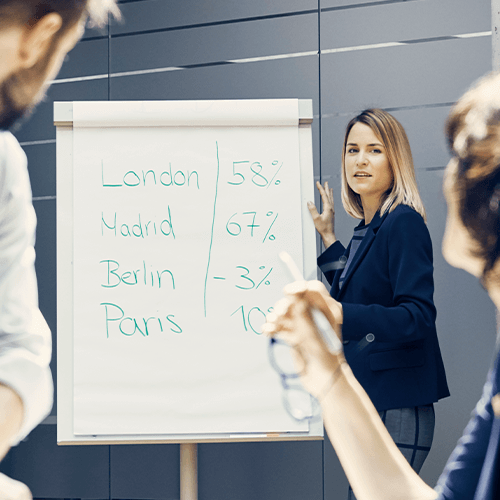

Supporting you with global accounting and advisory services

If you are at the start of your global journey or already a multinational organisation, our team is ready to advise or manage the process for you.

Advisory

From strategic planning and acquisitions to internal audits and forensic investigations. Our UK team and access to Kreston Global means we can match your ambitions.

Learn more

Global mobility

Whether you have or want to employ individuals abroad, relocating your home or retiring overseas, our experts understand the tax efficient requirements and will help you to ensure compliance with regulations.

Learn more

International tax planning

Thanks to our Kreston Global membership, we regularly work on cross-border tax projects with over 5000 tax experts in 120 countries, knowing their country's tax environments inside out.

Learn more

VAT and duty

The increasingly complex VAT and duty regulations requires clear and knowledgeable advice tailored to your requirements. Rupert Moyle, Partner and Head of VAT and Duty sits as the Kreston Global Indirect Tax Group chair, evidencing our expertise in this area.

Learn more