Seonad Macleod

- Corporate Tax Manager

- +44 (0)330 124 1399

- Email Seonad

HMRC release statistics on R&D tax credits once a year, and published their latest release earlier this week (30 September).

For the real enthusiast, the full statistics are available on the government website at Corporate tax: Research and Development Tax Credits – GOV.UK.

I am an enthusiast, and have been digging into the latest statistics. There have been some dramatic reductions to both the number of claims made and the number of first-time claimants. Meanwhile, the absolute value of R&D relief has held steady – it was around £46.1 billion in 2023/24, compared to £46.7 billion in 2022/23 and £45.1 billion in 2021/22. This means that whilst many companies are getting more benefit, many others are failing to claim.

This is interesting for a few reasons, but first, let me set the scene.

Specialist R&D tax relief is designed to support innovative companies by reducing their corporation tax liability or providing them with a tax credit in cash. It is, at least in theory, supposed to incentivise investment in R&D, ultimately increasing economic growth. This is central to the government’s Plan for Change.

However, it is a tax relief that has been seen as a soft target for fraud. There have been a number of headline grabbing instances of fraud, and the level of fraud and error in the system is thought to be significant (£759 million in 2022-23 per HMRC’s latest annual report). HMRC has the task of administering the system and has invested significant resources in fighting fraud and error.

To further this fight, HMRC have significantly increased the number of enquiries they open into R&D claims. There has also been an overhaul of the claims process in recent years. From August 2023 onwards, for example, companies were required to describe their R&D projects for the first time (it had always been best practice to do so, but prior to this a claim could be made simply by entering one number in a corporation tax return). For accounting periods beginning on or after 1 April 2023, many companies now must notify HMRC in advance that they will be making a claim through a Claim Notification Form. R&D relief itself is also becoming less generous for many small and medium sized enterprises (SMEs), making it less attractive to companies with a low R&D spend.

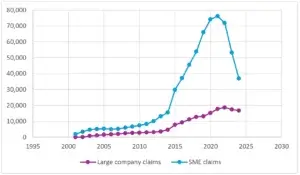

The graph below clearly shows that the number of claimants has fallen significantly from its peak. As a word of caution, the latest available figures included in the below are HMRC’s figures from 2023-24. It is likely that these will be revised as more information becomes available.

This fall is not seen for all sizes of claim. Whilst the number of claims has reduced, the average claim value has increased. HMRC publish the number of claims by value, and we can see that the number of claims with a value greater that £5,000 have decreased by around 74% since their peak in 2021, whereas the number of claims with a value of less than £500,000 has held reasonably steady, with an increase in the number of claims with a value of less than £2 million.

There is currently no limit to the size of an R&D claim. A company can submit a claim with a value of just £1 (although it would be an awful lot of effort to go to for very little return!). This was not always the case – before 1 April 2012, HMRC required a minimum spend of £10,000. In HMRC’s latest consultation they have asked about whether there is a minimum expenditure below which significant R&D does not place.

Although there is no hard limit on claim size, we find, from a cost-benefit perspective, it will not always be worthwhile to prepare small claims, even when it has been in the past. There are a number of contributing factors:

1. R&D relief for SMEs is less generous than it used to be. Previously, SMEs could benefit from an additional tax deduction of 130% of their qualifying spend, but this has reduced to 86%.

2. The administrative cost of preparing a claim has increased – most significantly due to the need to submit detailed project descriptions to HMRC.

3. HMRC enquire into far more claims than they have historically – and accepting the risk of an enquiry, which can be both time consuming and expensive, does put some companies off.

In next year’s statistics, most companies will move to the R&D merged scheme and the Enhanced support for Research & Development intensive small or medium enterprises (ERIS) scheme. This change continues to favour the large companies, with smaller profit-making companies receiving significantly reduced support.

For each company, there we will be a different spend level at which it is not commercially viable to make a claim. This is where our expertise can really assist as we may able to help you identify additional R&D expenditure, help you prepare for claims in future years or go through whether the claim is commercially viable for your company.

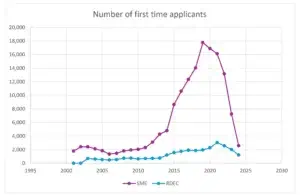

Far fewer companies are claiming R&D relief for the first time, with a 59% drop this year on top a 41% drop last year. We are worried about this – if your company is entitled to R&D relief, we want you to access it! R&D relief is still a very generous tax relief, even if barriers to claiming have increased in recent years.

1. It may be that companies with small potential claims decide not to claim for the reasons outlined above.

2. Companies may have wanted to claim, but have missed out as they have not submitted a Claim Notification Form (CNF). If you are required to submit a CNF but have not, you cannot claim R&D relief. We do not want anyone to miss out because of an administrative oversight – we have published some guidance here on Claim Notification Forms. If you would like to discuss a claim notification form, please get in touch.

3. A number of “rogue agents” have gone out of business, some due to targeting by HMRC. These agents previously attracted a lot of business by direct marketing. Companies that only would have prepared claims due to this direct marketing would not have prepared claims this year.

R&D for tax purposes is not just the preserve of scientists in white coats. It is available where a project seeks to achieve an advance in science or technology – and this can a vast range of businesses.

HMRC analyse claims by Standard Industry Classification (“SIC”) code, which describes the nature of a company’s business. They then group these SIC codes into sectors. We strongly suspect that HMRC are using these SIC codes and sectors to risk-assess claims and help them decide which claims to enquire into. In other words, if your company is in a sector that does not make many R&D claims, any R&D claim may be at higher risk of enquiry.

There has been a noticeable shift in the sectors that are claiming over time.

Whilst HMRC’s headline figures use the number of claims in their headlines, I think expenditure is a more useful statistic because the value of R&D activities are taking place as opposed to the value of tax credit.

Meanwhile, there has been a significant reduction in the value of claims (again compared to 2022) made by the accommodation and food sector (down 61%), real estate sector (down 67%) and education sector (down 61%). There are some that may argue that these are sectors less likely to engage in R&D, and that this reduction is a good thing, with companies are no longer making spurious claims. The other possibility is that these sectors have been under increased scrutiny by HMRC, and that genuine claimaints have decided not to risk making a claim, due to a perceived higher risk of enquiry and its associated costs. I think it’s probably a bit of both.

It is worthwhile making sure that your company uses the correct SIC code, that accurately reflects the nature of your business, before making any R&D claim.

The R&D landscape has changed significantly in recent years, and that is reflected in the statistics. R&D relief is potentially highly valuable. It is, however, complex, and obtaining specialist advice from a reputable firm is highly recommended.

We have a team of specialist advisors, who are there to help you navigate the system. If you would like assistance with R&D relief, please do get in touch.

Share this article

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Related people

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Our complimentary newsletters and event invitations are designed to provide you with regular updates, insight and guidance.

You can unsubscribe from our email communications at any time by emailing [email protected] or by clicking the 'unsubscribe' link found on all our email newsletters and event invitations.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.