Kim Williams APFS

- Financial Planning Director and Chartered Financial Planner at Kreston Reeves Financial Planning Services Limited

- +44 (0)330 124 1399

- Email Kim

Suggested:Result oneResult 2Result 3

Sorry, there are no results for this search.

Sorry, there are no results for this search.

View all peoplePublished by Kim Williams on 11 August 2023

Share this article

I receive many questions about retirement planning and the most common ones are:

However, the answer is not that simple as it depends on a number of factors:

What age you want to retire

What your retirement expenditure will be

Will you use income drawdown or purchase an annuity

Can you afford to save the maximum into pensions now to achieve your long term goal

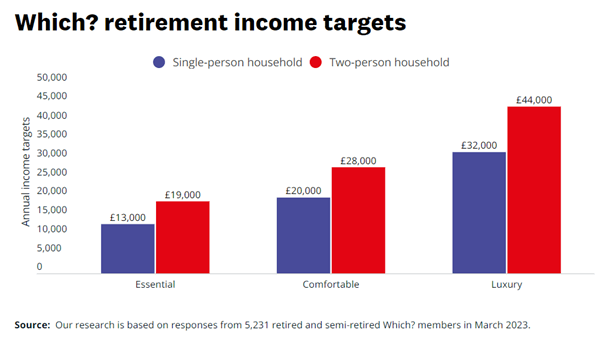

This illustration has been sourced from Which?

Most of us will want a ‘comfortable’ retirement so the average spending for a two person household is £28,000 gross a year. If you are looking for a more luxurious retirement to include larger holidays, home improvements and a new car frequently then a two person household will need £44,000 a year gross.

Check your state pension forecast to ensure that you are ‘on track’ to receive the full state pension. This is currently £10,600 so a couple could achieve a retirement income of £21,200 a year from the state alone. This could cover your essential expenditure but saving personally into pensions means that you will have a better lifestyle and more choices when you retire.

The table below sets down the value of your pension needed to achieve these different levels of lifestyle as provided by Which?. I have assumed that any tax free payment is made (i.e. 25% of your pension fund) which gives you a cash buffer for any emergencies.

| Lifestyle | Annual Net Expenditure* | State Pension** | Private Gross Pension income | Private Pension Fund size required |

| Essential | £13,000 | £10,600 | £2,510 | £73,500 |

| Comfortable | £20,000 | £10,600 | £11,266 | £313,000 |

| Luxury | £32,000 | £10,600 | £26,300 | £734,000 |

*Based on a single person household

**Assumes full state pension is accrued (23/24 figures)

Assumptions:

Please note that these annuity rates were correct on 28th June 2023. They are not guaranteed and will move up and down.

Many of our clients are wanting to retire earlier than their state pension age. If this is the case then saving additional amounts into private pensions is key to planning your retirement income. You may decide to retire from your current role and phase into your retirement by opting to carry out a different part time role. This can sometimes bridge the gap between semi-retirement and your state pension being paid.

It is not all about pensions. Your retirement income can be funded from other assets such as a buy to let property, an investment portfolio or simple savings accrued in the bank. We can prepare a financial plan using all of your assets to ensure that your needs can be met.

For advice around retirement savings please contact our Financial Planning team on +44 (0) 330 124 1399 or provide your details on our online enquiry form.

Share this article

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Our complimentary newsletters and event invitations are designed to provide you with regular updates, insight and guidance.

You can unsubscribe from our email communications at any time by emailing [email protected] or by clicking the 'unsubscribe' link found on all our email newsletters and event invitations.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.