Simon Webber BA(hons) DChA FCA

- Audit Partner and Head of Academies and Education

- +44 (0)330 124 1399

- Email Simon

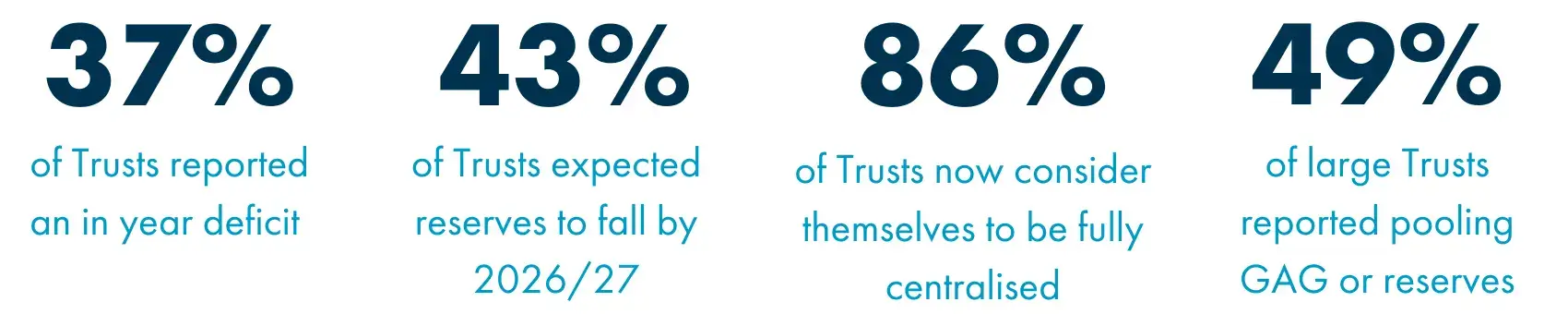

The 14th annual Kreston Reeves Academies Benchmark Report published today showed Academy Trusts of all sizes have achieved their strongest financial performance in three years. Just 37% of trusts reported in-year financial deficits in 2024/25, a dramatic reversal of the state of academy finances in the 2023/24 academic year, when 60% of trusts were in deficit.

However, these buoyant results have done little to boost confidence across the sector as almost all trust types forecasted reserves to plummet over the next two years. This bleak outlook is particularly stark in secondary single Academy Trusts (SATs), where reserves are expected to fall 43% by 2026/27.

Simon Webber, Partner and Head of Academies and Education, said: “Academy Trusts have reported improved results in 24/25, however this is the result of strong cost control and in-year funding that wasn’t expected, rather than significant changes to the financial environment schools are operating in.

“Trusts still face considerable challenges, with rising costs always at the back of the mind. As a result, investment and growth plans continue to be moderated.”

The size of a trust remains a key factor in determining its financial performance. Larger multi Academy Trusts (MATs) have returned average surpluses of £1.1 million this year. In SATs and smaller MATs, surpluses were much more modest at less than £50,000 on average.

Reserves told a similar story. Only 25% of trusts overall were holding less than 5% in reserves, the level the Department for Education (DfE) considers may be a sign of financial vulnerability. However, reserves in small trusts fell to just under 12% of income (11.5%), down from 13% last year, while in larger trusts, reserves remained steady at 8%.

Multi-Academy Trusts continued to grow this year, but there are clear signs that the pace of expansion is forecasted to slow across the sector. Trusts now average just under 14 schools, up 8% from just over 11 in the previous year, but far fewer are planning to add new academies in the future. Last year, 61% expected to gain at least one school in 2025/26, rising to 83% by 2026/27. This year, just 36% expect to expand over the next 12 months, a drop of 25 percentage points.

Simon Webber said: “Whilst trusts have grown over the past 12 months, that growth is predicted to slow considerably. Many trusts are considering a period of consolidation and those that are still able to achieve growth are doing so with caution, especially when taking on a school that needs to be turned around.”

Costs of teaching and support staff continue to place enormous pressure on Academy Trusts, with 90% now reporting this as one of their biggest financial concerns, up from 81% last year.

Rising salaries for teaching and support staff, along with additional tax burdens, have made budget planning increasingly difficult. This pressure is particularly evident given that staff costs in 2024/25 accounted for more than 75% of income for all trust types, a commonly used benchmark for financial health and sustainability.

Only 11% of trusts said the funding they received for school meals was sufficient to cover the cost of providing them. Local authorities are increasingly introducing automatic enrolment or opt-out initiatives for free school meals, which could have a significant impact on their ability to support more families and ensure trusts receive the funding they are entitled to.

Simon Webber said: “Teaching and support staff costs have always been the largest element of any school budget, but their relative increase above 75% leaves little room for manoeuvre when budgeting, especially if also needing to fund a shortfall in free school meal provision.”

Nearly all Academy Trusts generated between 0.1 to 0.3 tonnes of CO₂ per pupil this year, with trust size having almost no impact on emissions. With little change from last year, the sector’s progress on cutting emissions has plateaued, leaving the prospect of meeting the 2050 net zero targets in doubt.

Dan Firmager, ESG Advisor, said: “Progress on emissions has stalled not because of a lack of intent, but because trusts are constrained by capital, leaving culture as the lever most firmly within their control. A clear, focused Climate Action Plan helps shift attention to what can be achieved now through smarter use of existing resources and sustained behaviour change.

“To move forward, trusts need to embed climate action into their culture, not as a compliance task, but as a shared priority that shapes daily decisions and long-term impact.”

Sustained high interest rates over the past four years have been good news for Academy Trusts, generating significant extra income from financial surpluses.

Large MATs led the way with a return on investment of £39 per pupil, but returns were strong overall, averaging £33 per pupil. This is an increase on last year’s £29 returns per pupil, reflecting trusts’ ongoing commitment to maximising income and strengthening financial resilience.

Other interesting findings include:

For more information about the Kreston Academies Benchmark Report 2026, or if you’d like to speak to a member of our team about your academies and education sector needs or ESG ambitions, please contact us today.

Published annually by Kreston UK academies group, a network of accounting firms, the report is a financial state of the nation survey of almost 250 Trusts representing more than 2,500 schools and almost one fifth of all children educated in academies in England. The survey covers the 2024/25 academic year.

Yes. Trusts delivered their strongest financial performance since 2022, with only 37% reporting an in‑year deficit (down from 60% in 2023/24 and 49% the year before).

Average free reserves increased year‑on‑year, stabilising sector finances; however, 26% of Trusts still held 0–5% of income in reserves—a range the DfE views as potentially vulnerable. The report also notes average reserve ratios broadly unchanged year‑over‑year (approx. 7.7%–14.8% by Trust type).

Outperformance versus budgets was largely driven by the late‑announced Core Schools Budget Grant (CSBG) and other in‑year funding that Trusts hadn’t assumed when submitting Budget Forecast Returns, alongside continued cost control.

For the first time in the survey, the average CEO salary in large MATs exceeded £200k, even as overall leadership cost per pupil in large MATs fell relative to wider staff cost growth, indicating efficiency at scale.

The average MAT size rose to 13.6 schools (from 11.7 last year), but expansion plans have cooled: only 36% expect to grow in the next 12 months, down from 61% in the prior survey.

SEND demand and funding shortfalls remain a top risk; while government has pledged additional SEND support and structural reforms, uncertainty over timing and sufficiency still forces short‑term decisions and complicates planning.

86% of Trusts are now fully centralised, up 8 percentage points year‑on‑year. Pooling continues to rise, especially reserves pooling, with ~49% of large MATs pooling by 2025, up from 41% in 2024.

With a specific interest in the education sector Simon looks after a client portfolio which includes private tutoring businesses, independent and academy schools as well as a number of educational charities. He was a founding member of the Chichester Free School and, in his four year role as finance Governor, was part of the project team that secured the funding agreement. Click here to learn more about Simon Webber

Share this article

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Related people

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Our complimentary newsletters and event invitations are designed to provide you with regular updates, insight and guidance.

You can unsubscribe from our email communications at any time by emailing [email protected] or by clicking the 'unsubscribe' link found on all our email newsletters and event invitations.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.