Academy Benchmark Report – Another year of record-breaking surpluses

In January, Kreston International published its 10th annual Academies Benchmark Report. The survey of over 300 Trusts representing over 1,500 schools has reported record surpluses, buoyed by substantial Covid-19 financial support, resulting in even stronger Trust financial health than before.

Over the next few weeks, we will look in more detail at the research and explore what impact the pandemic has had on the financial performance of academies and the pressures they face in the future that might eat into the financial gains of the last two years.

In this, the first of three articles, we will look at the strengthened financial performance we are seeing across the sector.

Financial statements of academies are notoriously difficult to understand and interpret, so let’s start by defining what we mean by a surplus or a deficit:

In short, the surplus or deficit is the profit or loss made for the year. However, the financial statements will include non-operational items such as depreciation, pension costs and any capital movements that muddy the waters for seeing the true underlying result for the year. We remove these for the purposes of the discussed results.

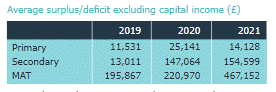

The table below, taken from the Academies Benchmark Report, shows that although there has been a small reduction in the average in-year surplus for SATs, there has been an 11.5% increase in the average surplus for single secondaries, whilst the surpluses for MATs have more than doubled to well over £450,000.

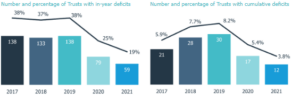

The two charts below highlight the impact on the in-year and cumulative deficits. The first chart shows that the number of Trusts with in-year deficits has fallen to 19%, falling significantly in the last two years after a period of consistently high levels of in-year deficits. The second chart shows Trusts with accumulated deficits also falling sharply over the same period.

These record-breaking surpluses shown above are largely a result of the lockdowns and boosted funding in the government’s response to the pandemic – in purely financial terms it has proved a lot cheaper to close a school than to keep it open! Deficits incurred in the autumn terms were countered by large surpluses in the Spring and Summer terms.

These figures matter. Academies are required to set balanced budgets each year but are allowed to draw upon unspent funds brought forward from previous years. So, these surpluses are now available for trusts to begin the challenge of bridging any potential learning gaps after the various lockdowns.

In our second article, we will ask whether these increased surpluses and strengthened financial positions are sustainable? To answer this, we need to look further into why the sector is showing record-breaking financial results.

And in a third and final article, we will explore what the future may potentially hold for academies and the impact this will have on financial performance and position.

It is clear to see that the impact of the pandemic and associated lockdowns on the education sector will be felt for years to come.

For more information about the topics explored in this article, contact us here.

Share this article

Email Kelly

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Related people

Peter Manser FCA DChA

- Head of Audit and Assurance, and Academies and Education Partner

- +44 (0)330 124 1399

- Email Peter

Email Peter

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Email Simon

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Subscribe to our newsletters

Our complimentary newsletters and event invitations are designed to provide you with regular updates, insight and guidance.

You can unsubscribe from our email communications at any time by emailing [email protected] or by clicking the 'unsubscribe' link found on all our email newsletters and event invitations.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.