Dipesh Galaiya BSc (Hons) FCA

- Private Client Tax Senior Manager

- +44 (0)330 124 1399

- Email Dipesh

Suggested:Result oneResult 2Result 3

Sorry, there are no results for this search.

Sorry, there are no results for this search.

View all peoplePublished by Dipesh Galaiya on 17 May 2023

Share this article

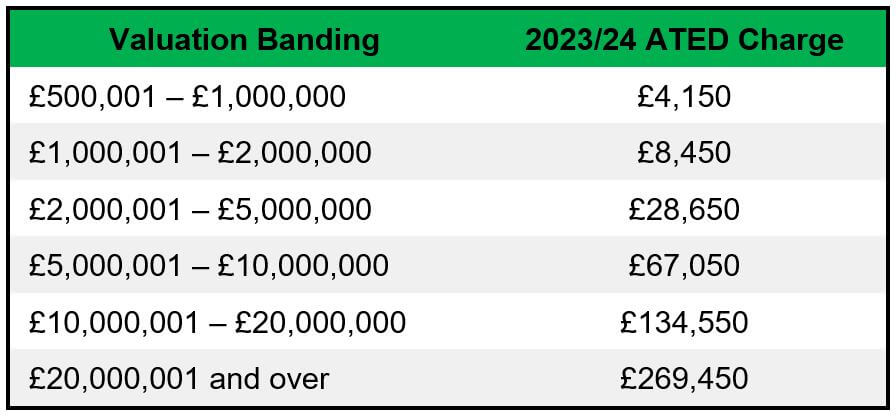

The filing deadline for the 2023-24 ATED returns passed on 30 April 2023. However, with a change in valuation date to 1 April 2022 more residential property owners may unknowingly be subject to these rules.

First introduced with effect from 1 April 2013, the ATED is an annual tax which applies to non-natural persons (NNP) (i.e. companies, partnerships with at least one corporate member and collective investment schemes including unit trusts) which hold UK residential property. Since 2015 this has applied to properties over the value of £500,000.

An ATED return covers the period from 1 April to 31 March for the year in advance and NNP must file their ATED returns by 30 April. There is an annual charge based upon the property value unless you can demonstrate that you meet the conditions for one of the reliefs available. It is important to note that the reliefs are not automatic, and must be claimed on an ATED relief return. A relief return will however cover all qualifying properties owned by that NNP.

The ATED rules require a revaluation of existing properties every 5 years after 1 April 2012. For periods up to 31 March 2023 the valuation date was 1 April 2017 or the acquisition date, whichever is later. However, from 1 April 2023 the key valuation date will change to 1 April 2022 or the acquisition date, if later.

The valuation must be on an open-market willing buyer, willing seller basis and be a specific amount. Whilst a formal valuation is not strictly required, it is advisable to use a property professional (for example, a surveyor or estate agent) in order to ensure that the figure is robust and reasonable. HMRC guidance also confirms that the valuation must be a specific amount rather than a ‘within the range of’ type valuation.

The revaluation creates a grey area and a cause for concern. For those who have not previously submitted ATED returns because the valuation of their property as of 1 April 2017 was marginally below £500,000 could now find their properties have crept into the bandings for ATED and are now subject to completing annual returns. Normally, an ATED return must be made within 30 days of the date on which the property first comes within the charge to ATED.

Penalties can be issued in line with the standard late filing penalties of a corporation tax return for non-compliance, even where no tax is due.

One of the most common reliefs is lettings relief. To qualify the NNP must be letting the property to a third party tenant on a commercial basis or at least available on the market.

Other reliefs are available where the property is:

The relief can cover either a full period or in part. Where there is a change in use during the ATED period then the position needs to be reassessed and the relevant returns, and payment made (on a pro-rata basis), where appropriate.

UK property can often be owned by non-UK entities. These types of structures will often be caught by the ATED rules. Since October 2022, HMRC have been issuing ‘nudge letters’ to tackle non-compliance, including ATED. Click here for further information about overseas entities.

Where an offshore company owns UK property then we are seeing more requests to see if that structure is still fit for purpose. This ‘de-enveloping’ may now be subject to a double charge to tax on the increase in the value of the property (from 2015) and the increase in the value of the shares (from 2019). It may therefore be best to act sooner rather than later in extracting property from these structures in order to mitigate the increasing double tax costs, and the significantly high costs levied by offshore fiduciaries.

If you have further questions about annual tax on Enveloped Dwellings (ATED), or you’re interested in guidance on the matter, please contact us today.

Share this article

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Our complimentary newsletters and event invitations are designed to provide you with regular updates, insight and guidance.

You can unsubscribe from our email communications at any time by emailing [email protected] or by clicking the 'unsubscribe' link found on all our email newsletters and event invitations.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.