Brexit implications for audit exemption, small companies within a group and ineligible groups

Last updated 4 January 2021

Background

The UK Brexit transition period ended on 31 December 2020 and whilst most businesses are focused on the potential changes to trade tariffs and import and export requirements, it is worth highlighting the subtle changes to audit exemption for subsidiaries of existing EEA groups and the definition of an ineligible group. This article also serves as a timely reminder for circumstances where small companies do not qualify for audit exemption, particularly where they are part of a group.

Requirements for an audit

The Companies Act 2006 (CA 2006) states that a company’s annual accounts for a financial period must be audited unless the company is exempt from audit (section 475). There are currently four possible ways to qualify for audit exemption:

- Dormant company

- Standalone small company

- Small member of a small worldwide group

- Any sized subsidiary in a UK or EEA group with a parent guarantee

Each of these potential ways to obtain audit exemption contains its own requirements and conditions, which should be carefully considered before taking the exemption.

It should also be noted that the members of a company have an option under section 476 of CA 2006 to require the company to have an audit where they hold at least 10% of the nominal value of the company’s issued share capital (or at least 10% in number of the members where there is no share capital). The Articles of Association or other governing documents could also contain specific provisions requiring an audit.

UK or EEA group with parent guarantee

Since 1 October 2012, where a company is itself a subsidiary company and its parent is established under the law of a UK or EEA state, it has been possible to obtain audit exemption via a parent guarantee, the requirements for which are outlined in section 479A of CA 2006. There are a large number of requirements to meet in order to claim this audit exemption, including the requirement to file the parent’s consolidated audited accounts at Companies House.

Brexit change

For accounting periods commencing on or after exit day (defined as 11pm on 31 December 2020), the exemption under section 479A of CA 2006 will only be available to subsidiaries with a parent undertaking established in any part of the UK.

Standalone small company

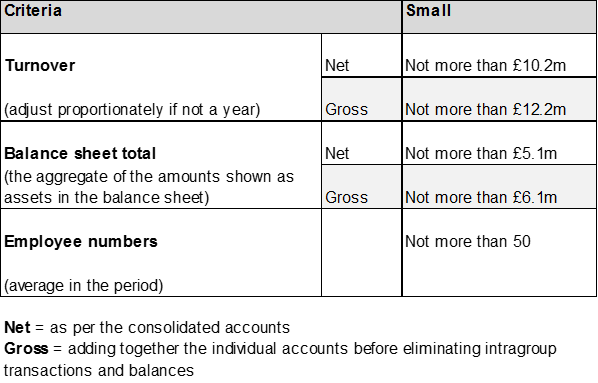

Standalone companies that qualify as small companies under CA 2006 are usually exempt from audit. A company is small if for both this year and last year it was not ineligible, and it met two out of three of the criteria in Table 1 (net limits). This applies to the first financial period and it takes two years to change size.

A company is not entitled to this exemption if it meets the definition of any excluded companies as set out in section 478 CA 2006. This includes a public company, an authorised insurance company, a banking company and an e-money issuer.

Small member of a small worldwide group

A small company that is a member of a group will also need to consider the size of the entire group of which it is a member and whether any group member makes the group ineligible. This involves looking at those entities both above and below itself in the group, as well as those in different branches of the group structure.

To qualify as a small group, the group must meet two out of the three requirements set out in Table 1, applying either the net or gross thresholds (or a combination of both). This applies to the first financial period and it takes two years to change size.

A group cannot qualify as small and is an ineligible group if at any time within the financial year any of its members meets the definition set out in paragraph 2 of section 384 CA 2006. This includes a traded company, a body corporate (other than a company) whose shares are admitted to trading on a regulated market in an EEA state, an authorised insurance company, a banking company and an e-money issuer.

The small companies regime does not apply to a company that is part of an ineligible group.

Brexit change

For accounting periods commencing on or after exit day, paragraph 2(b) of section 384 is changed to read “a body corporate (other than a company) whose shares are admitted to trading on a UK regulated market”and the definition of a traded company is amended to be a company any of whose transferable securities are admitted to trading on a UK regulated market (rather than in an EEA state).

Table 1:

1 The EEA includes EU countries and also Iceland, Liechtenstein and Norway.

2 The AIM market is not a regulated market (ESMA’s register may be used to identify regulated markets).

Please do not hesitate to contact Peter Manser or Joe Timms to discuss any specific auditing questions related to company size and group scenarios that you may have.

Share this article

Email Joe

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Related people

Peter Manser FCA DChA

- Audit Compliance Partner and Head of Academies

- +44 (0)330 124 1399

- Email Peter

Email Peter

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Subscribe to our newsletters

Our complimentary newsletters and event invitations are designed to provide you with regular updates, insight and guidance.

You can unsubscribe from our email communications at any time by emailing [email protected] or by clicking the 'unsubscribe' link found on all our email newsletters and event invitations.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.