Max Masters FCCA ACCA

- Accounts Senior Manager

- +44 (0)330 124 1399

- Email Max

Suggested:Result oneResult 2Result 3

Sorry, there are no results for this search.

Sorry, there are no results for this search.

View all peoplePublished by Max Masters on 18 January 2024

Share this article

Planning ahead allows you to both attract and retain talented individuals and avoid nasty surprises.

As part of our last ‘Looking ahead’ webinar for professional practices (October 2023), I spoke about the importance of regularly reviewing and updating your firm’s succession planning. It may seem obvious, but it is one of those issues that gets pushed to one side when everyone is busy with fee earning work.

There are many factors to consider, such as the age at which existing partners will retire and the need to evaluate the cost of new entrants into the firm, to support working capital.

However, other important considerations are likely to be non-financial, including how individual purposes align with the cultures and values of the firm and having clarity on the steps needed to progress within the firm.

Therefore, it is necessary to think about the structure of the company articles or the partnership agreement to protect the firm.

It is also imperative to undertake some cashflow forecasting to inform your decision making and identify any potential issues should things not go to plan.

It is essential that firms seek specialist tax advice before making any decisions. It is a complicated area where careful consideration needs to be given on the values involved and the various elections which might have to be made to HMRC.

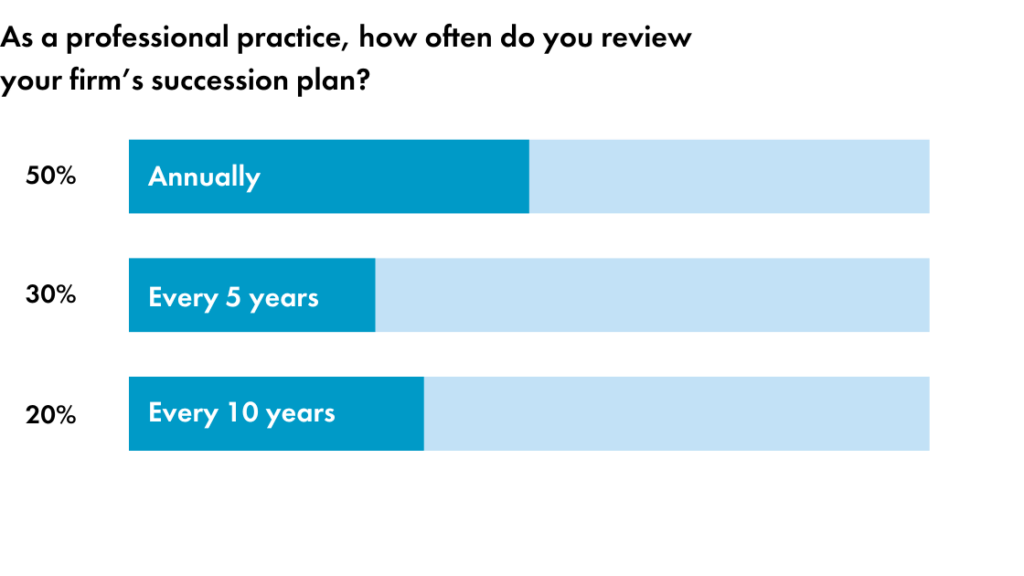

It was pleasing to see that from our webinar, half of the participants of the poll undertake a review of their succession planning on an annual basis. However, with 30% reviewing their plans every five years and 20% every two years, there is certainly room for improvement.

Don’t forget to factor in the speed at which technology and in particular AI may change your business, your key sectors, and your clients in the years to come, as this will shape your business and succession planning. As to what extent, we are still understanding, but, in five, ten or maybe 20 years’ time the business landscape will be very different. Businesses need agility to be able to survive and thrive.

Take time to review your firm’s internal governance documents – are they still fit for purpose, and do they align with future plans?

Finally, consider how confident you are in your staff and your current partners plans for the future. These plans should be stress tested to assess the impact of any unexpected events – perhaps by utilising some forecasting tools.

If you would like further information, please get in touch.

Share this article

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Our complimentary newsletters and event invitations are designed to provide you with regular updates, insight and guidance.

You can unsubscribe from our email communications at any time by emailing [email protected] or by clicking the 'unsubscribe' link found on all our email newsletters and event invitations.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.